Who Else Wants Info About How To Reduce Social Security Tax

Currently, many retirees pay taxes on their social security benefits.

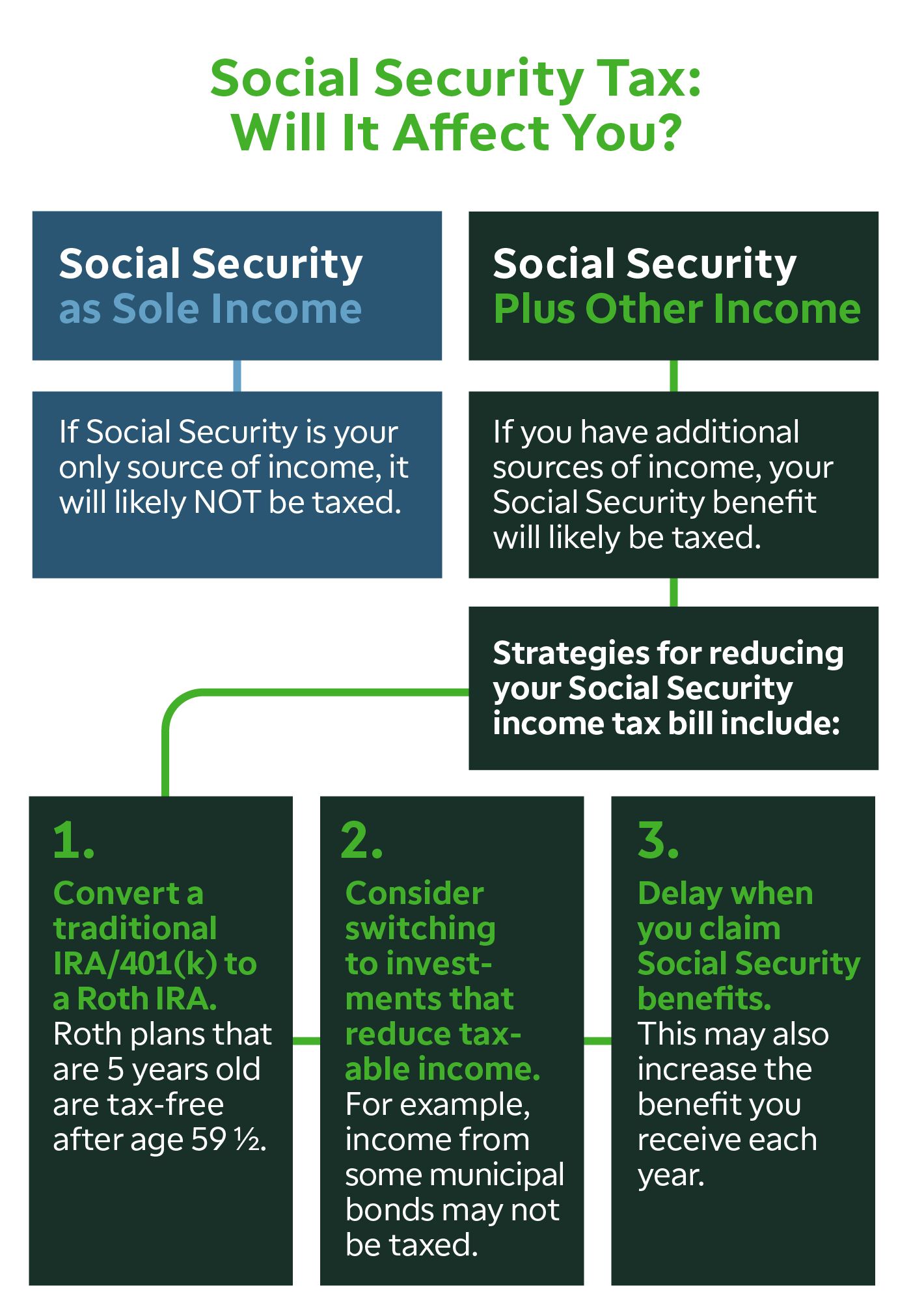

How to reduce social security tax. How to minimize taxes on your social security if your social security benefit is relatively fixed, albeit with small annual increases, you really have only two avenues left to. As much as 85% of. See these tips on how to reduce those potential taxes.

I just read for the third time that converting to a roth ira can reduce taxes on social security benefits. Another way to reduce taxable income: If you need more information about tax withholding, read irs publication 554, tax guide for seniors, and publication 915, social security and equivalent railroad retirement benefits.

Yes, with the caveat, for seniors. a 2021 bill that polis signed allows people 65 and older to deduct all of their social security income from their colorado taxable. Lowering your combined income can help reduce the amount of social security income that is subject to tax. Does the roth reduce social security benefits?

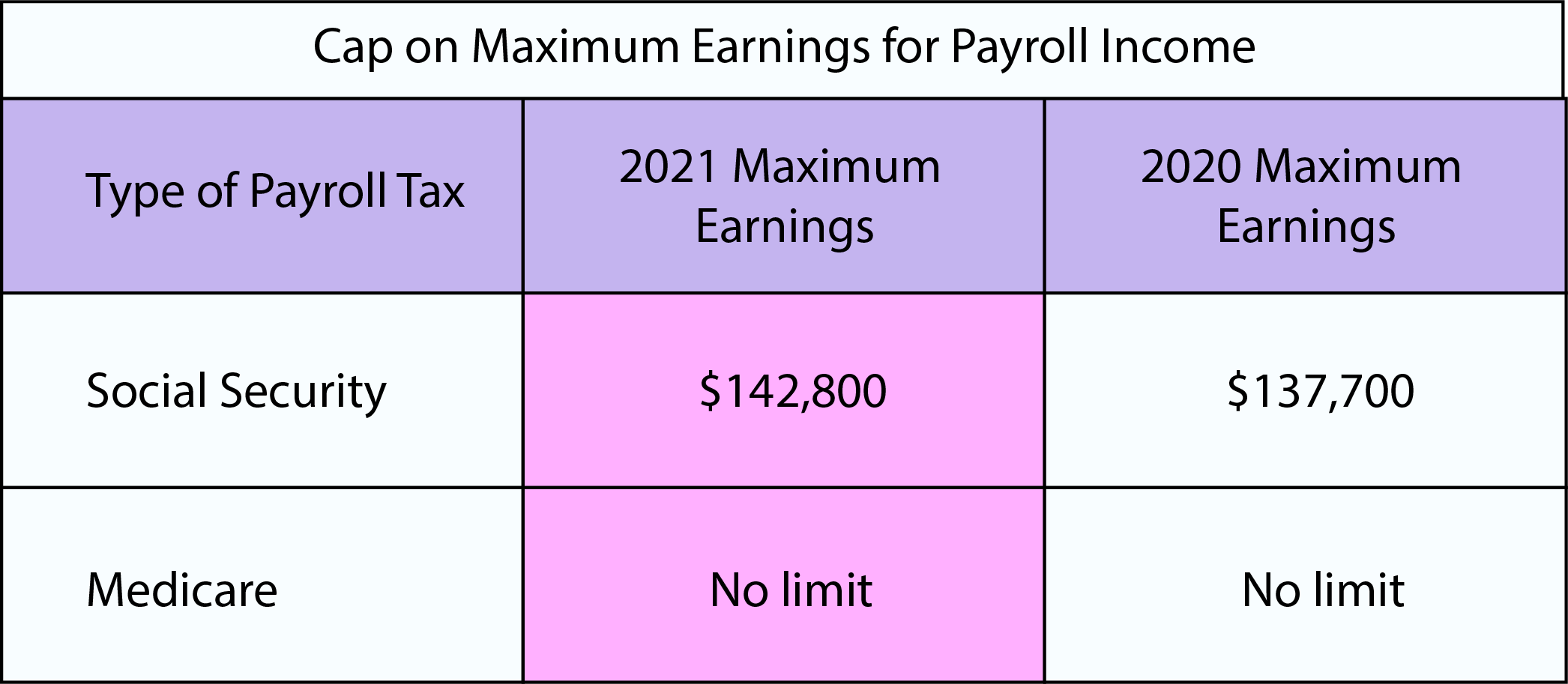

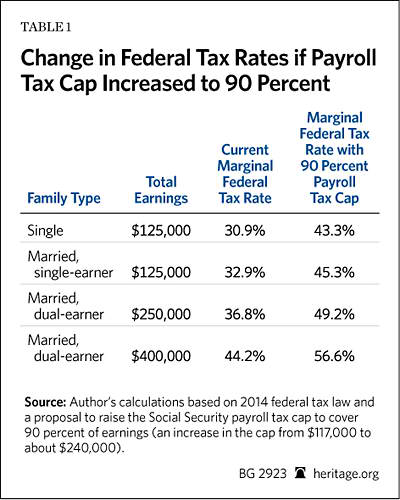

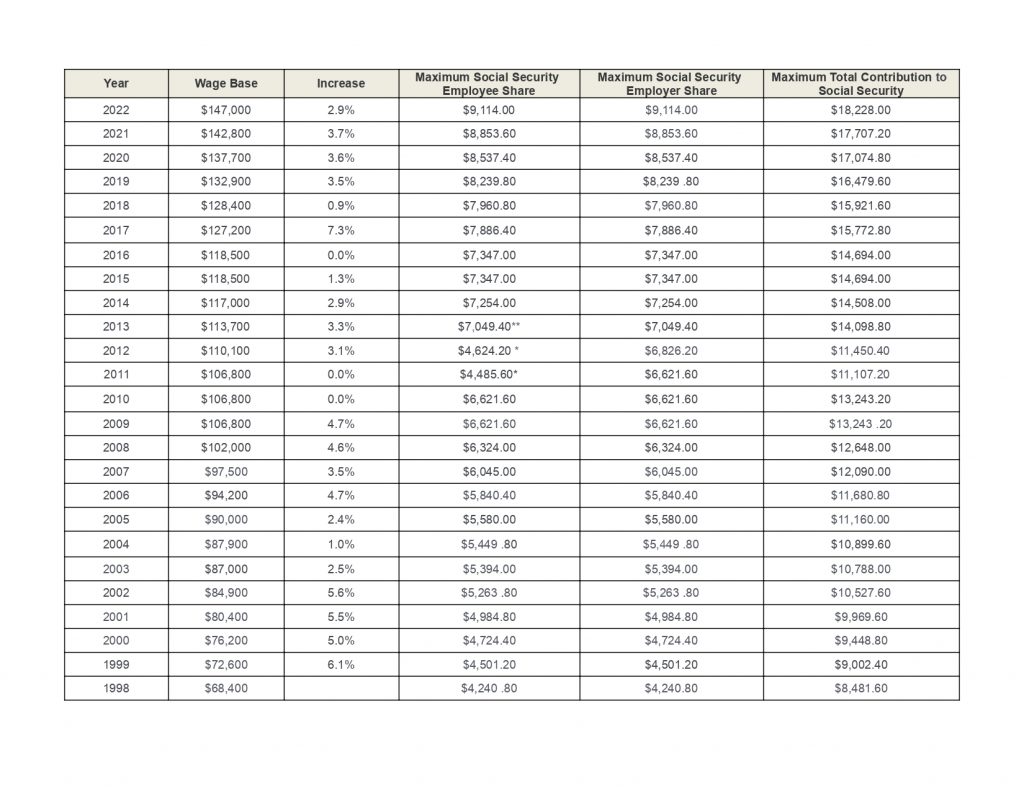

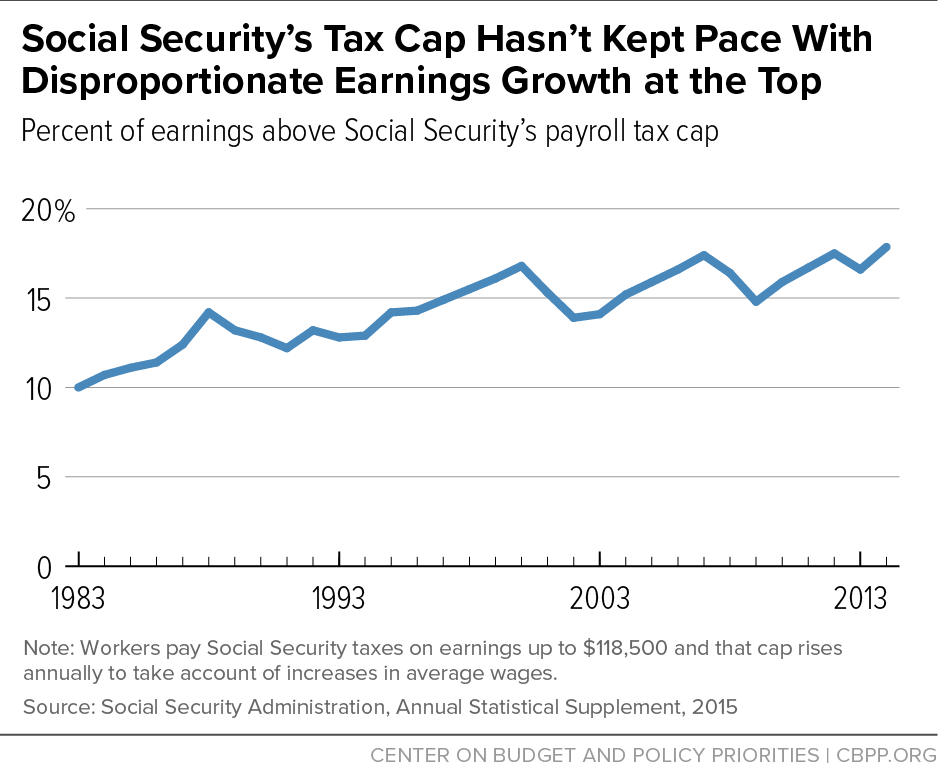

Up to 85% of social security income may be taxable. The primary source of funding for social security is fica taxes. There are many factors that influence how your social security income impacts your taxes.

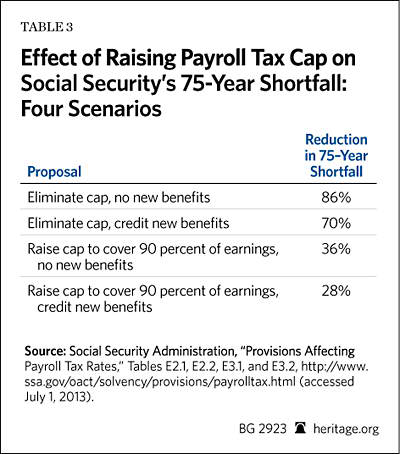

That rises to $32,000 if you’re married and filing a joint return. Benefit reductions to fix social security. 3 ways to avoid taxes on benefits place some retirement income in roth accounts.

Today, the social security administration estimates more than half of beneficiaries are subject to taxes. The basic rule is that social security benefits are taxable if your modified. If you paid social security taxes on 30 years of substantial earnings, wep does not apply to you.

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)