Great Tips About How To Deal With Collectors

If the court rules against you and orders you to pay the debt, the debt collector may be able to garnish — or take money from — your wages or bank account, or put a lien on.

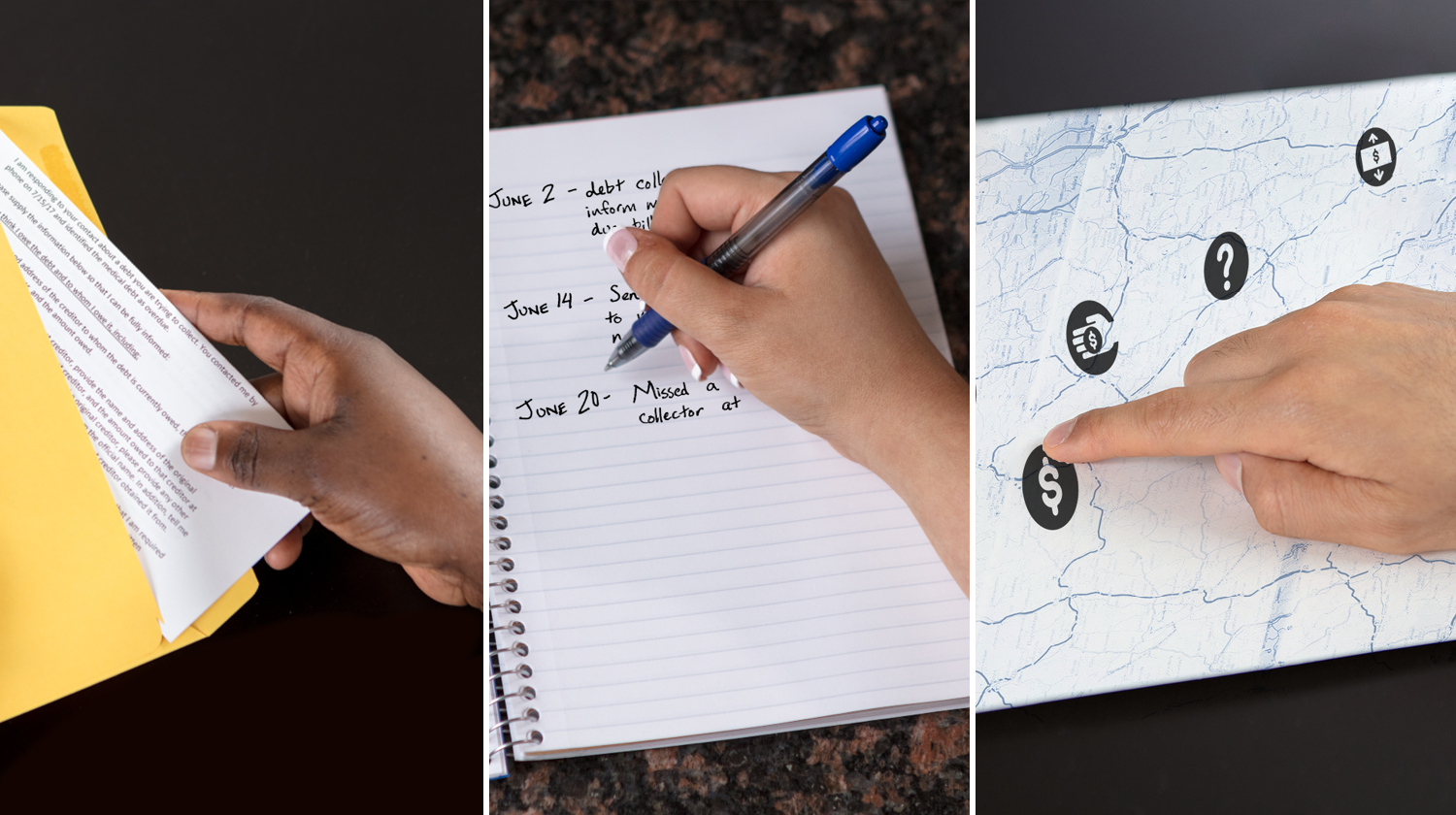

How to deal with collectors. You should also ask for proof of the debt collector's claim that you owe money, such as copy of a. Now let’s look at the reasons for how we successfully dealt with debt collectors. Instead create a legal answer that disputes the debt and requires the debt collector to prove you owe it.

Mail a letter to the debt collector stating the amount that they're saying you owe is incorrect. How to deal with debt collectors on your own? Treat anyone who contacts you with basic human respect.

First of all, it is important that you keep. Getting out of paying debt collectors is tricky, but it’s not impossible. But by keeping a level head and taking proactive steps, you can protect yourself from potential scams or harassment.

If the collection agency contact is by phone call, you may request the debtor send you a debt validation letter to verify the amount the debt. You can get debt collectors to stop. Validate and verify within five days of contacting you, a collector must send a written debt validation notice that.

Best ways how to deal with debt collectors when you can’t pay 1. How to successfully deal with debt collectors 1. Verify your debt, avoid scams!

Ultimately, you have three options. Dealing with debt collectors can be stressful. If you are struggling to deal with a debt collector, there are a few things you can do.

![How To Deal With Debt Collectors (Don't Do These 7 Deadly Sins) [Free Pdf]](https://www.frugalconfessions.com/wp-content/uploads/2020/03/how-to-deal-with-debt-collectors.jpg.webp)