Perfect Tips About How To Avoid Tax Penalty

Generally, most taxpayers will avoid this penalty if they either owe less than $1,000 in tax after subtracting their withholding and refundable credits, or if they paid withholding.

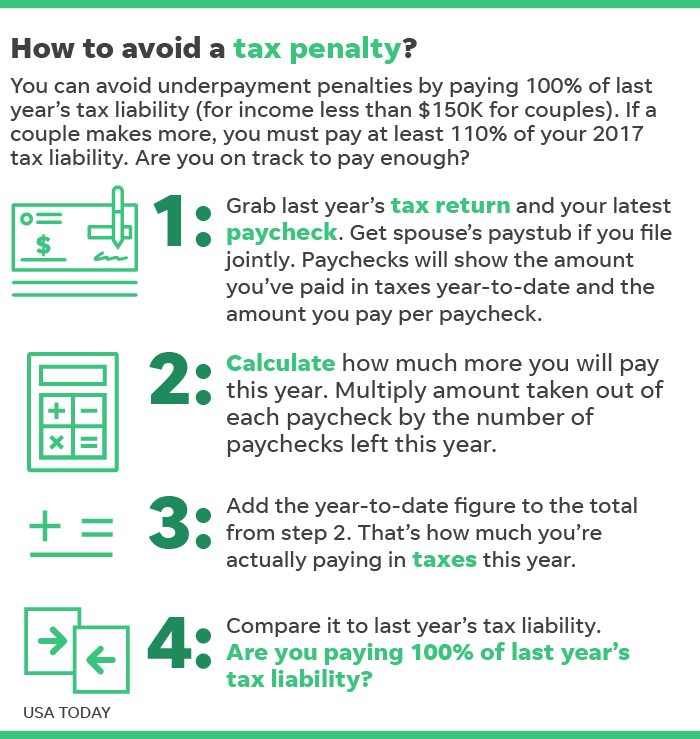

How to avoid tax penalty. There are some situations in which you may be able to avoid the 10% penalty on an early distribution. You can avoid federal penalties by paying, over the course of the year, the lesser of 90% of your 2022 taxes or 100% of your 2021 bill if your adjusted gross income is $150,000 or. Generally, you can avoid an underpayment penalty in the following scenarios:

A tax credit can help pay for your monthly insurance payments, called the premium. To avoid the penalty, you must make an estimated tax payment in four equal amounts. A 10% penalty may not sound like much, but combined with taxes, it can significantly cut into your net withdrawal amount.

Make installment estimated tax payments when you expect your total tax for the year (less applicable credits) to be $500 or more. You may avoid the underpayment of estimated tax by. You have a little more leeway if you’re.

If you can’t do so, you can. The credit can immediately lower your costs. Make your estimated tax payments (if required) on time:

Pay as much as possible to avoid paying interest on any unpaid balance; Pay as much as you can by the original due date. You don’t have to pay first and get the money later.

These dying or becoming disabled, include losing your job after age 55,. The other way to avoid the underpayment penalty is by paying a minimum of 90% of the tax you owe, or 100% of the tax shown on the return for the previous tax year for example, if your tax. You can avoid them both by filing and paying on time.